When unicorns go extinct: Why HIT investors must go back to the basics, especially market diligence

With speculation that the U.S. economy is headed for a recession, questions have arisen about the future of health tech companies. Instead of raising large sums of money and hoping success catches up, health tech companies must now be prepared to operate in an environment with an increased focus on growing viable, profitable enterprises.

During a decade-long run of growth, some investors, many of which were newer entrants, softened market due diligence. Instead, they focused on speed — deploying their capital to cash in on quick wins. In their minds, with everything going so well, how could a deal go bad?

Under normal circumstances, market diligence represents the foundation upon which big money decisions are made — the culmination of thesis development, business plan analysis, and thorough research on growth potential, competitive landscapes, ability to weather economic storms, and a myriad of other factors.

Over the last few years, a frenzied market caused many investors to overlook market fundamentals, creating a highly undisciplined investing atmosphere. Despite valuations in the billions, deals were often done in a very non-scientific way.

Olive is perhaps one of the earliest and most notable examples. Just 12 months ago, it was a health tech darling with a valuation upwards of $4 billion. Last month, the unicorn publicly changed course when it reduced its workforce by 35%, citing a declining economy, operational missteps, increased competition, and changing customer expectations. In a letter to staff outlining the company’s decision, CEO Sean Lane identified the breakneck speed of expansion as Olive’s key misstep: “Our fast-paced growth and lack of focus strained our product and engineering resources and prevented us from executing quickly on key initiatives.”

While this reversal in fortune is indicative of larger market forces, it offers a clear warning sign to the industry: gone are the days of quick and massive prospecting investments. In today’s turbulent landscape, the often-monotonous work of properly vetting an investment has never been more important.

The oft-sought total addressable market (TAM) number can be a comforting KPI. Many believe that if the market is big and penetration is low, there is good reason to deploy dry powder — especially in an industry that saw ten years of technology advancement in as little as 12-18 months.

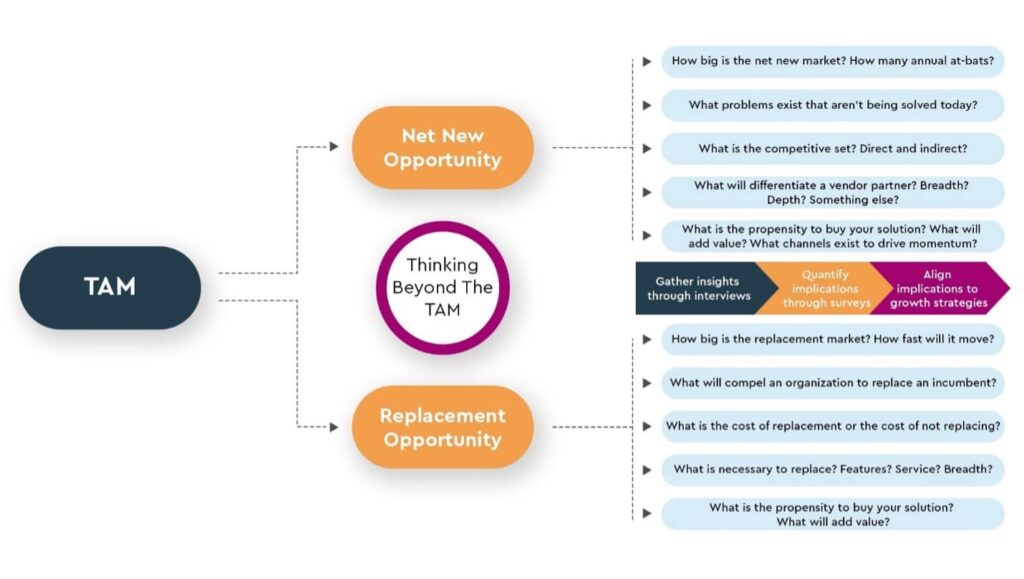

Please don’t get me wrong – TAM matters. But TAM alone does not go far enough. We often say, imagine that the TAM and a profit and loss (P&L) statement had a baby…can we invest in a big market opportunity and build a profitable business? We call this Thinking Beyond the TAM, and this analysis requires investors to answer a series of questions on the market and value of the solution.

THINKING BEYOND THE TAM

As the market continues to evolve, we believe that deeper insights will once again rise to the top investors’ priorities.

Dan D’Orazio is CEO of Sage Growth Partners, a research, strategy, and marketing agency that accelerates commercial success for growth-minded healthcare organizations, and performs numerous buy and sell-side diligence.

FOLLOW US!