Looking forward and back is what makes Sage, Sage

The news that AI-chip innovator Nvidia is now the world’s most valuable company reminded us of the summer of 2023, when Sage marked Apple’s $3T valuation moment. Today, Nvidia has blown past that mark, becoming the first to reach $5T.

Nvidia is flush because its hacked value and scale: the company delivers highly specific results (more on this in a bit) that address broad categories of need. Healthcare has been seeking these same concretes and growth multiples from its tech investments, deploying AI at more than twice the rate (2.2x) of the broader economy.

It all begs the question: If Nvidia is dominating AI and AI is dominating healthcare, what will shape our industry until the next trillion-dollar milestone or if the AI bubble bursts?

One AI chip to rule them all

To grow, profit and lead, companies must deliver problem-solution fit and product-market fit — not one or the other. Nvidia delivers both in a big way. Here’s how, followed by what it means for healthcare:

- Problem-Solution Fit: Nvidia focused early on graphics processing units (GPUs) — they perform the simultaneous calculations that train and power AI models — and built a general-purpose platform to go with it.

- Product-Market Fit: This go-to combination is now the industry standard for AI and machine learning, making Nvidia the market and profit leader.

- Domination: Nvidia’s invest-and-iterate juggernaut has resulted in an addressable and obtainable market share — ranging from 75-95%, depending on what you read — that nearly equals the total AI chip market. SAM + SOM = TAM is how companies become $5T monoliths.

Nvidia’s increasingly powerful AI chips are widely used by just about every industry, including ours. As highlighted in our recent HLTH recap, these investments are powering data, insight and systems innovations industry wide.

Still, the current state of artificial intelligence is riddled with paradoxes.

AI’s evolving use cases and ROI

AI can reduce costs but involves significant upfront investments. It can automate rote, administrative tasks but requires human oversight, particularly for clinical uses. It’s both a top tech initiative for the C-suite and one of its greatest challenges.

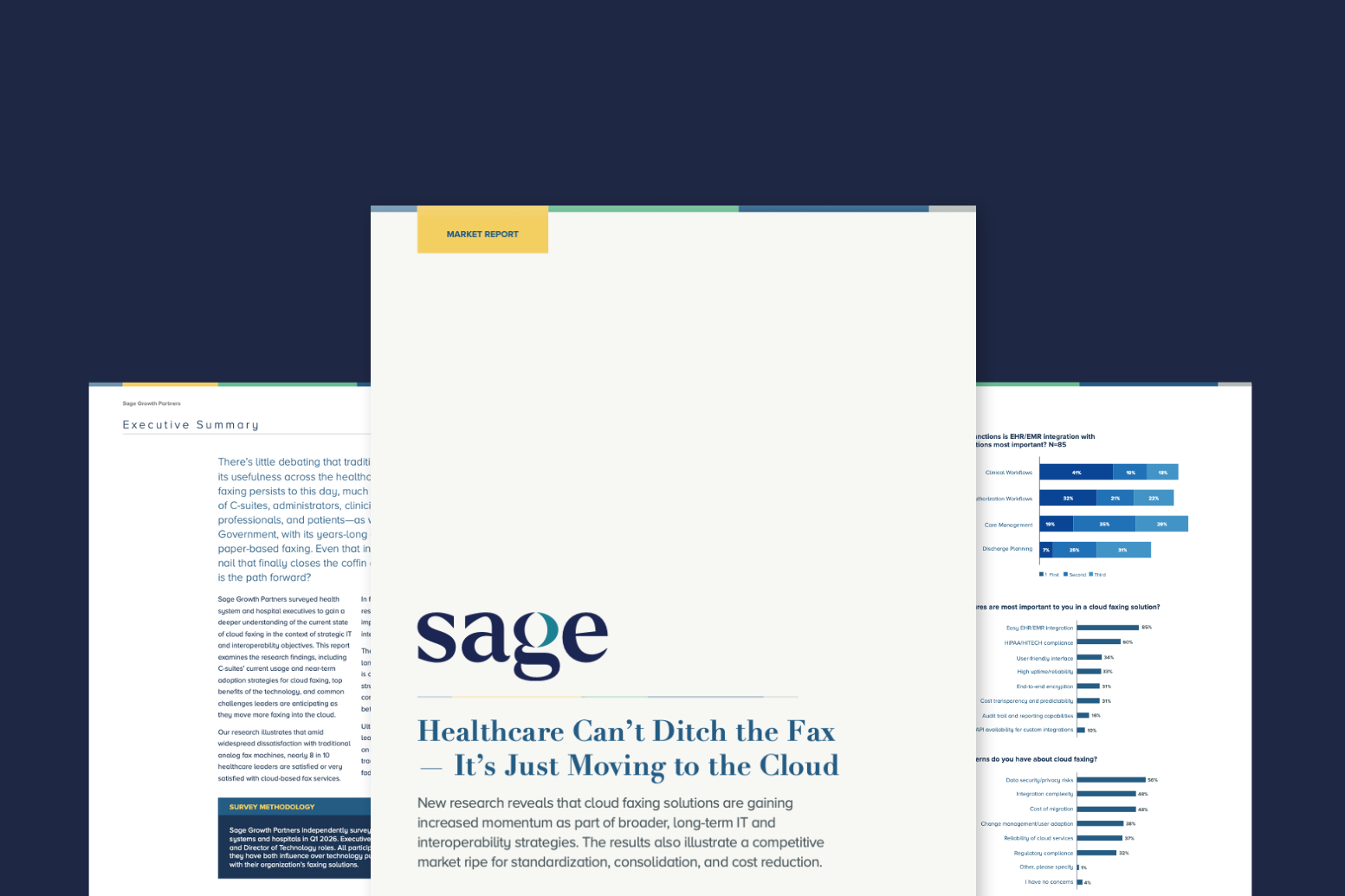

In Sage’s latest market report, 57% of C-suite executives ranked AI-based clinical solutions a top tech initiative over the next two years while naming total cost of care their greatest challenge.

Stafford Beer wrote that the purpose of a system is what it does (POSIWID), not what it was designed for or consistently fails to do. Healthcare has multiple, conflicting purposes that are notoriously difficult to achieve. Can AI improve patient care and experience, lower costs, and return margin simultaneously when so many attempts have failed?

Early use cases have been promising but limited with low-hanging fruit like revenue cycle. AI-based diagnostic solutions in oncology, cardiology, ophthalmology, even infectious diseases have reduced costs but with relatively unknown ROI.

But when fully tuned and applied to the right use case, AI’s value is more tangible.

- Sage clients like Phillips have partnered with Nvidia to build an AI-powered MRI with the higher resolution, interactive capabilities to improve diagnostic speed, patient experience, and quality care.

- Nvidia investor Microsoft has partnered with Mercy Health on an ambient AI nursing solution that has shown improvements in staff timeliness, overtime and even small bumps in patient satisfaction.

- Other nursing solutions, like Nvidia-powered Nurabot, are improving nurse access in underserved, rural areas.

Identifying the right use cases, validating them and developing effectiveness frameworks are important. So are the messaging, trust and buy-in that surrounds them. AI deployment brings AI misinformation. This spotlights AI’s role in not only healthcare but healthcare marketing.

The intersection of AI investment and AI leadership

Like ROI, valuation can be ambiguous and even misleading. When Apple crossed the $3T Rubicon, two things happened quickly. Its market cap dropped $130B and a long-standing question resurfaced: Was the company really worth that much? Is Nvidia?

Too Big to Fail left lessons unlearned, but the AI bubble doesn’t have to burst. Sage’s AI investments aim to toughen the bubble and shape its contours to deliver smart, responsible growth for our clients.

Fresh off our latest strategy retreat and our 20th year of doing things differently to deliver for clients, we’ve hired the highly sought-after Christina Speck as the firm’s first Chief Solutions and AI Officer.

AI is fundamentally reshaping how insights are generated, campaigns are personalized, and strategies are executed. Success now requires marketing partners who combine deep healthcare expertise with AI-enabled solutions. Christina’s hiring signals Sage’s commitment to leading this evolution with our partners.

You can learn more about Christina and Sage’s developing suite of AI solutions here. And stay tuned — 2026 is right around the corner and the best is yet to come!