Hospital and health system C-Suite executives are expecting economic turbulence in the months ahead. Although that’s not new or particularly novel to 2024—given the persistent macroeconomic conditions and looming threat of a recession—our annual Sage Growth Partners C-Suite survey gauged where leaders are currently looking to scale back. We also asked where the 108 executive respondents would invest if they had no financial constraints at all.

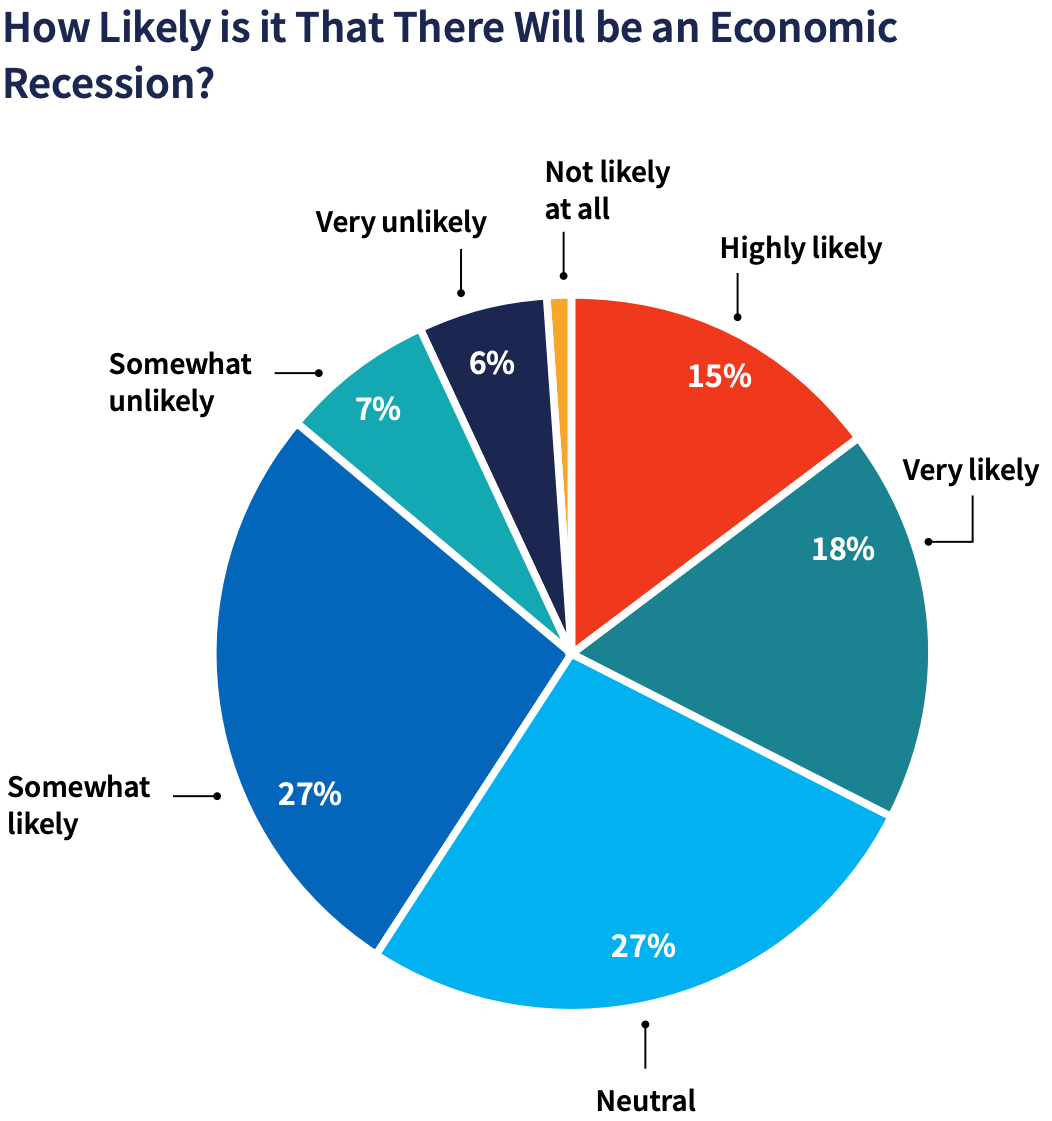

Given that fewer than 15% of survey respondents believe that a recession is unlikely, C-Suites are working to future-proof their organizations via a variety of tactics. But our research reveals significant reductions in the top techniques between 2022 and 2023.

Fifty-two percent of C-Suites, in fact, are reducing costs through improved efficiencies, down from 64% in 2022. Forty-two percent are reviewing suppliers to identify where they can limit the number of suppliers and switch to less expensive alternatives, while 64% limited suppliers in 2022.

When it comes to staffing, slightly more (46%) in 2023 are making changes than in 2022 (42%). In the 2023 survey, 11% of participating executives say their health system or hospital is not planning any measures at all to reduce expenses, an increase from 8% in 2022.

The need to invest in IT, and the potential for ROI, must be clear for C-Suites to consider taking action. In 2023, nearly half (47%) of executives say their organization is canceling or postponing new investments other than technology, which is consistent with the 48% that did so in 2022. More than half of C-Suites in both 2023 and 2022, however, say they are not canceling or postponing new technology investments as of now.

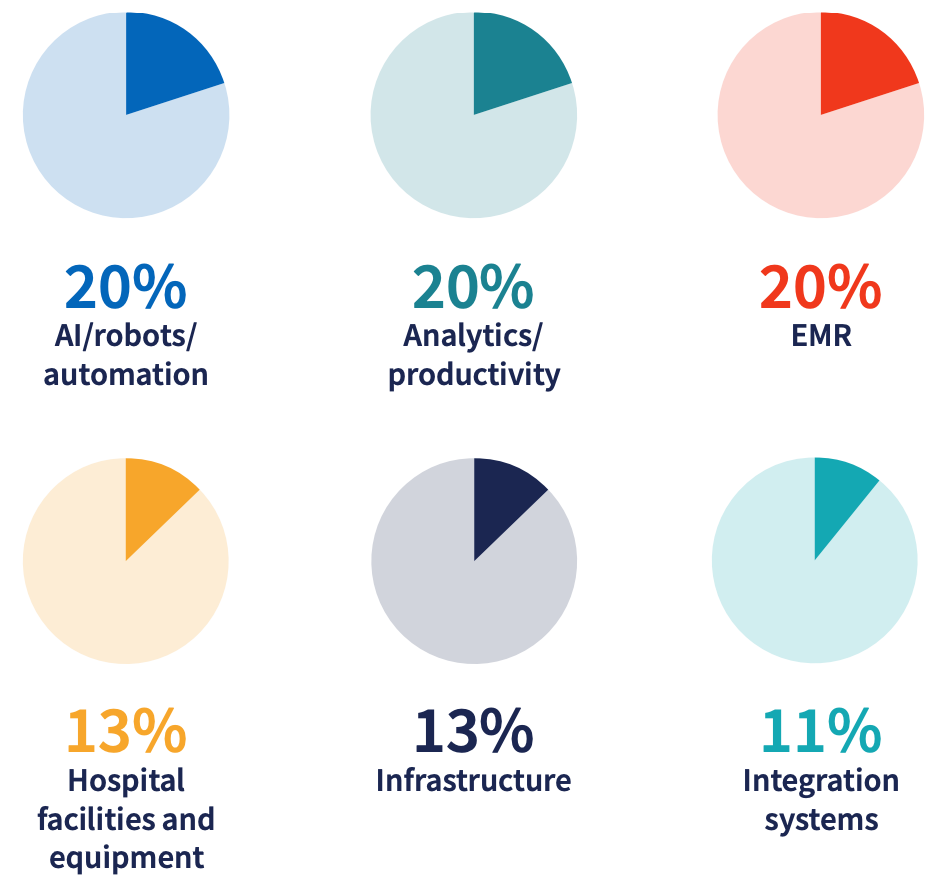

We also asked C-Suite leaders how their organization would invest if it was not facing any financial constraints (possible recession or otherwise) whatsoever. As unlikely as that scenario may be in the near-term (if ever), the executives’ answers offer a glimpse into their interest in emerging and advanced technologies. Notably, those include AI, robots, automation, and analytics. And then there’s the interminable need to improve electronic medical record (EMR) platforms, even more than 10 years after the HITECH Act incentivized EMR implementations.

While the C-Suite prepares for the worst, their sentiments provide a roadmap for agile HIT organizations. Those with unique differentiators and value propositions that support technology initiatives, revenue growth, organizational efficiency, and patient safety will be best able to weather the coming storm of budget cuts.

Thinking Big About Investments

When asked if their organization were given the opportunity to invest capital without constraints, C-Suites say they would opt for:

Download our full research report, The New Healthcare C-Suite Agenda: 2024-2025, to learn more about top strategic considerations, where healthcare organizations are investing in technology to achieve those, how EMRs are still failing to deliver on vendor promises, clinical and operational use cases for AI and where hospitals are exploring new ways to leverage AI, and more.