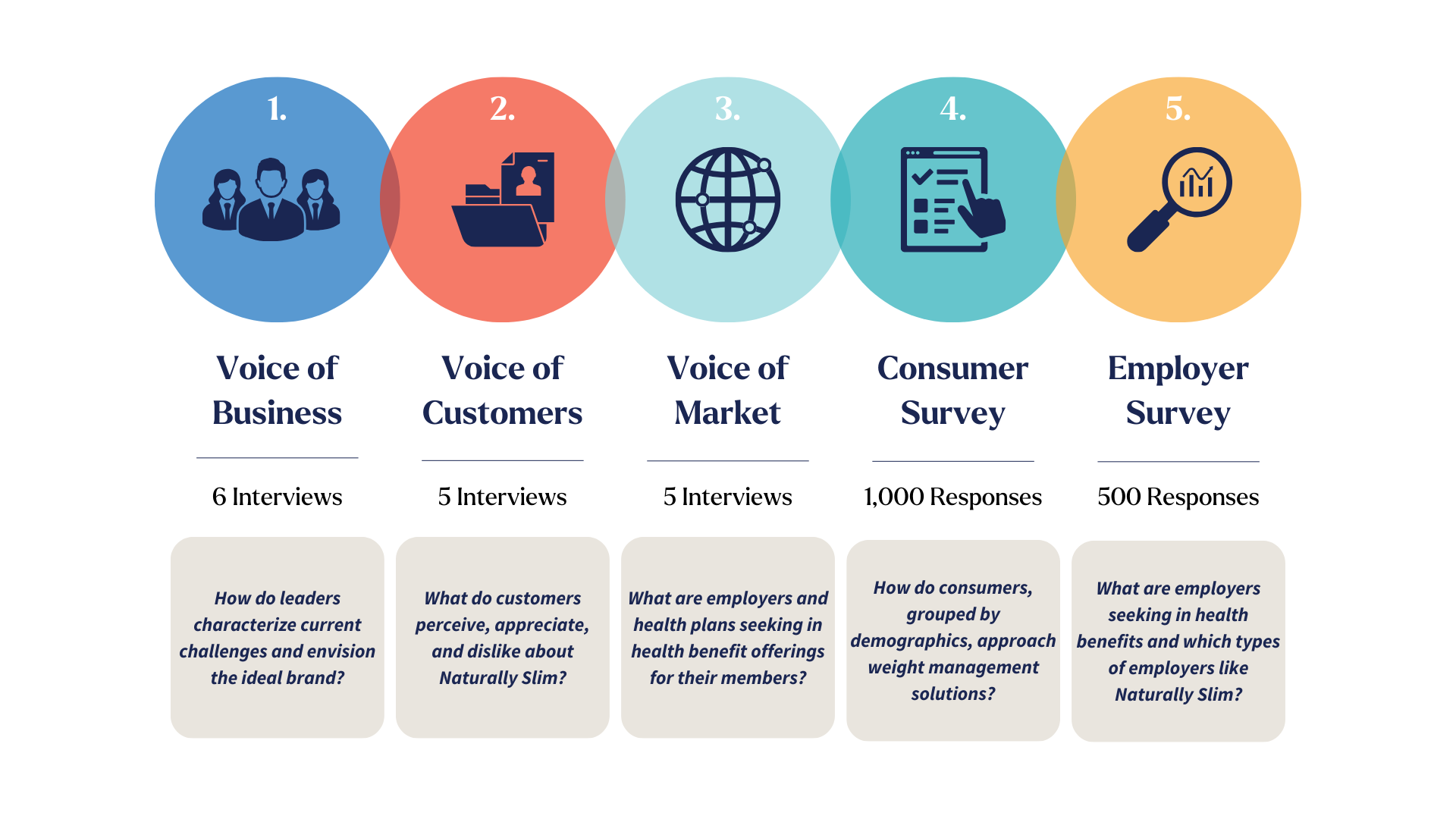

Qualitative Research

To get started, we conducted “voice of business” interviews with key leaders to understand the product, brand, company journey, value, and vision for the future. These conversations asked questions about the market and customer profiles, as well as headwinds, revenue drivers, customer and target sentiment, and more. To follow-up, we led conversations with existing customers to learn about their experience using the solution, and whether their sentiments aligned with the business’ hypotheses.

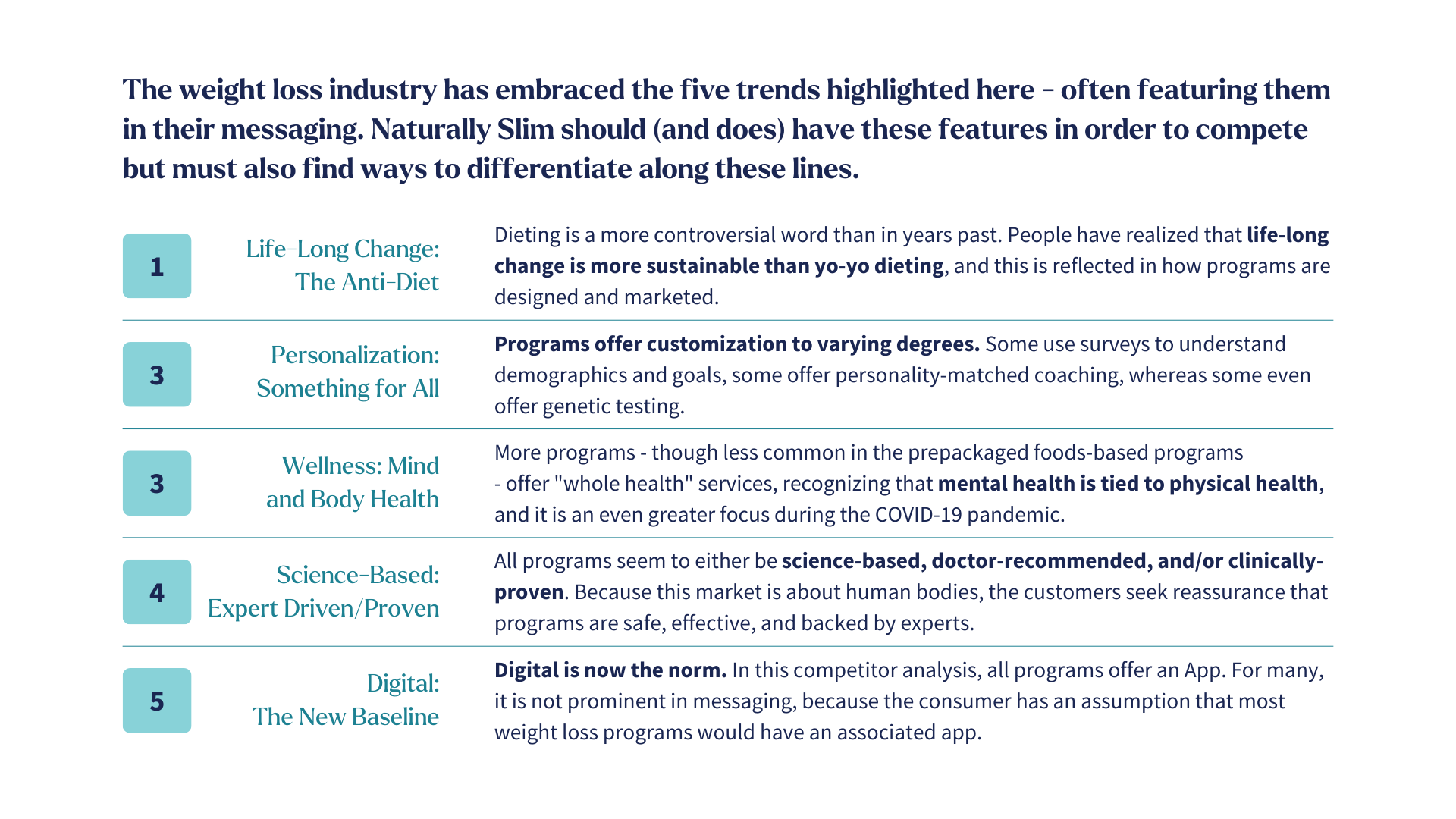

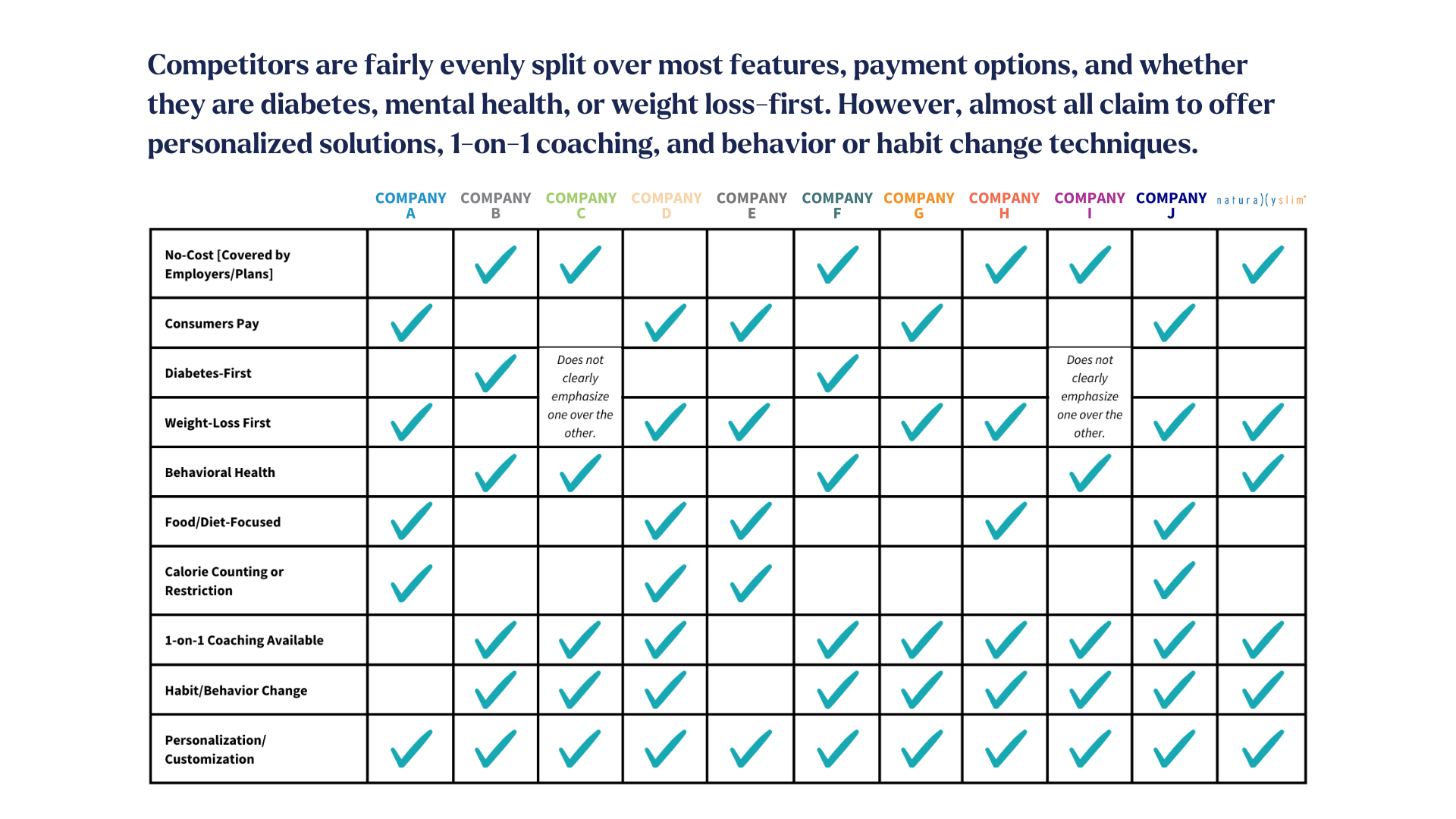

Competitive Research

To understand the current market lexicon, existing branding, and its resonance, we conducted an in-depth analysis of Naturally Slim’s competitive landscape. This research included identifying relevant competitors and the language and targeting strategies of each—to identify new opportunities to differentiate.

Quantitative Research

We conducted dual quantitative surveys to understand the market from both perspectives: B2B and B2B2C. The first, a consumer survey, collected 1,000 responses from across a representative array of target personas. It sought to uncover how consumers approach weight management. The employer survey fielded 150 responses from key benefits leaders responsible for making health benefits decisions for their organizations.

Buyer & User Personas

Leveraging the data gathered from the quantitative research, we crafted buyer and user personas that outlined common demographic identifiers, socio-economic characteristics, and behavioral characteristics to help define informed line of thinking for the brand assessment and naming conventions.

Brand strength assessment and naming recommendations

Based on the research outputs, the brand health calculations, and market landscape insights gleaned, Sage helped define positioning and messaging cues that would help guide the brand to its new identity.