Health IT Forecast in 3 Charts: Hospitals’ Top 2024 Capital Budget Priorities, Tech Initiatives, and Planned Investments for the Next 2 Years

Nearly half of hospital and health system C-Suite executives are planning to ramp up their capital investments over the next year—a rise since 2022, when it was fewer than one-third, according to our annual Sage Growth Partners C-Suite survey.

We asked 108 C-Suite executives which investments their organization is prioritizing to shape the next generation of healthcare, along with their top technology initiatives, and what technologies they’re planning to purchase in the next 24 months.

High priorities for capital budget planning include a stronger focus on care delivery and data analytics, while new markets and back-end systems both held steady compared to 2022. These investment priorities align with what we see as ongoing and pervasive challenges in the market—clinician and other workforce shortages lead to the need for more investments in care delivery solutions, and the need to focus on patient acquisition mirrors the ongoing challenge of hospital economics.

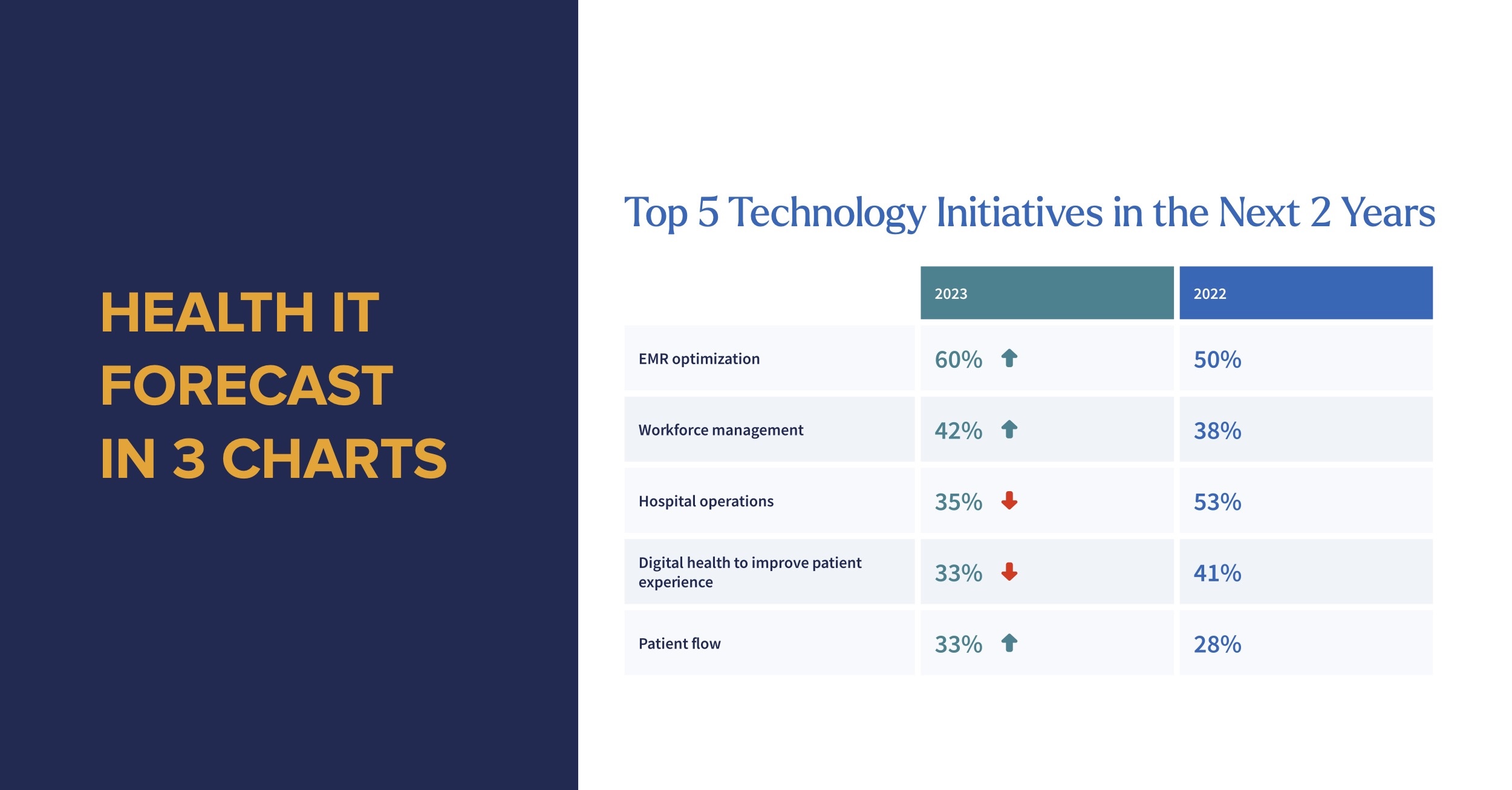

The top technology-driven initiatives health system and hospital C-Suites are pursuing also mirror the ongoing workforce challenges. These leaders are putting a more strategic focus on EMR optimization and workforce management.

Our research, however, shows less prioritization on digital health to improve the patient experience—illustrating a disconnect between the increasing need to acquire new patients and the slightly reduced investments into effective experiences that drive patient retention.

Looking beyond 2024, C-Suites are prioritizing analytics technologies to strategically leverage their data, and slightly more are planning to invest in revenue cycle management technologies than in our previous surveys. But among the top investment areas, hospitals or health systems are allocating fewer financial resources to the others than last year. In the case of cybersecurity, however, C-Suites are dedicating more resources now than they did in 2020—just not as much as in 2022.

C-Suites’ top factors for selecting technologies right now are: functionality, return on investment, and upfront cost. Relative to yielding a return on their health IT investments, most executives now expect to see ROI realized within three years, and only 20% say more than three years is an acceptable time-to-value.

C-Suites also say their organization is presently looking to purchase the following types of healthcare technology: either a new EMR or refinements to what is already in place, artificial intelligence, virtual monitoring, surgery/care technology, and revenue cycle management.

Regarding C-Suites’ preferred software pricing model, 44% say user licenses/consumption, similar to 2022 (46%). One-third (34%) say an average daily census is best, compared to 24% in 2022. Fewer than 16% in either year say pricing based on the number of licensed or staffed beds is their preferred model. Healthcare organizations’ primary method of technology acquisition is EMR-first (48%), best-of-breed (28%), and less than a quarter (24%) employ an EMR-only approach.

That said, our research also illustrates that across a range of technologies—from AI to virtual care—hospitals are investing outside their EMR. Why? C-Suite executives say EMRs are still not living up to vendors’ promises.

Download our full research report, The New Healthcare C-Suite Agenda: 2024-2025, to learn more about top strategic considerations, where healthcare organizations are investing in technology to achieve those, how EMRs are still failing to deliver on vendor promises, clinical and operational use cases for AI and where hospitals are exploring new ways to leverage AI, and more.