Sage Growth Partners Publishes New Survey Findings on Healthcare Venture Capital

Investors and CEOs differ on the number one value investors bring to the table; agree that selecting a proven team on both sides is paramount

Baltimore, MD – November 11, 2019 – The U.S. healthcare market saw a 14.4 percent increase in mergers and acquisitions from 2017-2018, fueled by soaring domestic venture capital investment – an all-time high of $130.9 billion invested in U.S.-based startups in 2018 alone. Compounding the pace and complexity of deal flow are sweeping industry trends ranging from managing and measuring health outcomes to reducing the overall cost of care.

Given this ripe environment, Sage Growth Partners (SGP), a Baltimore-based healthcare research, strategy, and marketing firm,conducted a market survey to gauge the relative priorities and attitudes of investors and CEOs of U.S.-based healthcare companies.

Key findings include:

INVESTORS WANT TO HELP CEOS RUN THE BUSINESS – BUT CEOS VALUE THIS LESS THAN OTHER BENEFITS

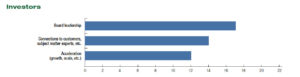

- When investors were asked to identify the top three benefits they furnish a portfolio company, providing board leadership (No. 1) and recruiting senior management (No. 4) were among the highest ranked responses.

- When CEOs were asked the top three factors they seek in a partner, the benefits cited by investors – board leadership (No. 7) and recruiting senior management (No. 9) came in at the bottom.

- Instead, CEOs cited credibility to the market (No. 1) and expertise related to the market (No. 4) among their highest ranked responses – whereas investors ranked credibility to the market as No. 8 and expertise related to the market as No. 6.

- Investors and CEOs are aligned on the value investors provide in making connections to customers and subject matter experts (No. 2 for both) and acceleration (No. 3 for both).

INVESTORS ARE LOOKING TO MITIGATE RISK

- When asked about markets that are most conducive to business growth, 63 percent said they would rather invest in a top 10 company in a fragmented market over a top three company in a consolidated market.

- This risk mitigation was also reflected by the 83 percent of investors who would prefer threats posed by competing businesses versus those resulting from regulation (17 percent).

PEOPLE COME FIRST: INVESTORS AND CEOS BOTH VALUE PROVEN TEAMS WITH A TRACK RECORD OF SUCCESS

By a 2:1 margin, investors indicated their preference for a company with a proven team and an average product (67 percent) over a company with a differentiated product and an average team (33 percent).

By a 2:1 margin, investors indicated their preference for a company with a proven team and an average product (67 percent) over a company with a differentiated product and an average team (33 percent). - In a separate question, investors unanimously preferred a differentiated product in a $1 billion market over an average product in a $5 billion market.

- Meanwhile, more than half (60 percent) of CEOs indicated that an excellent track record of success is more important in their choice of a financial firm than the terms of a given deal.

- Eighty percent of CEOs indicated that being a first-tier investment with a firm that is respected is more important than being a second-tier investment with a firm that is renowned.

“Business opportunities in healthcare today are driven by two key factors – the industry’s widespread waste and inefficiencies, and public and private sector mandates to reduce costs while increasing health outcomes,” said Dan D’Orazio, SGP’s CEO. “As a result, there is an abundance of potential partners and investment capital. It’s not surprising that investors and CEOs don’t completely see eye to eye on the perceived benefits of venture capital investment. However, they will have to find a way to successfully overlap their needs to benefit from the most valuable resource in their arsenal – the people.”

###

METHODOLOGY

Sage Growth Partners engaged 30 investors who have provided capital to healthcare companies at stages ranging from seed to buy-out; each had made at least one, and upwards of five, investments in the last 12 months. Also surveyed were 30 CEOs of healthcare companies, of whom half received funding in the past 12 months; the last round of funding received by the group of CEOs spanned from $250,000 to $100 million. At the conclusion of the survey, SGP made a donation to the Johns Hopkins Children’s Center on behalf of respondents.

ABOUT SAGE GROWTH PARTNERS

Sage Growth Partners accelerates commercial success for B2B, B2B2C, and B2C healthcare organizations through a singular focus on growth. The company helps its clients thrive amid the complexities of a rapidly changing marketplace with deep domain expertise and an integrated application of research, strategy, and marketing.

Founded in 2005, Sage Growth Partners is located in Baltimore, MD and serves clients such as Philips Healthcare, Quest Diagnostics, Hughes and Company, Olive, It’s Never 2 Late, and Noro-Moseley Partners. Visit us online at www.sage-growth.com.