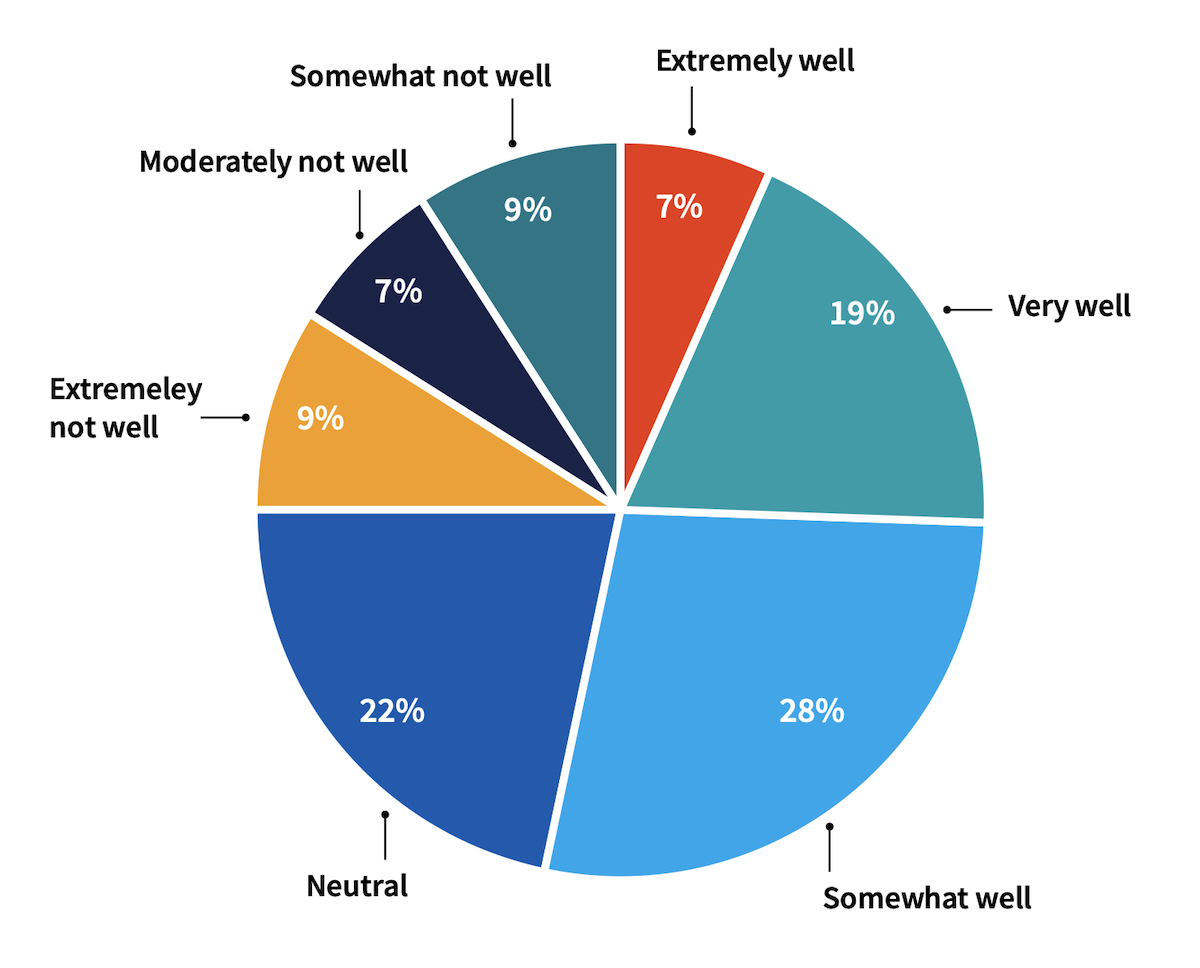

New research illustrates that health system and hospital C-Suites continue to be largely unhappy with their EMR vendor—and fewer executives than last year believe their current EMR will meet their organization’s needs for the future.

That dissatisfaction stems from a lack of data interoperability, frustrating integrations with other data sources and IT systems, as well as the general sense that EMR platforms are simply not living up to vendor promises.

To understand leaders’ perspectives on their current EMR, the top reasons they are looking elsewhere, and precisely where they are making those investments in technological capabilities, we surveyed 108 C-level executives for our annual Sage Growth Partners survey, The New Healthcare C-Suite Agenda 2024-2025.

More than a decade after the HITECH Act incentivized EMR implementations, in fact, only 17% of C-Suite respondents “strongly agree” that their existing EMR will meet the majority of the organization’s needs moving forward. That is notably fewer than the already-slim 25% in 2022 who indicated that they expected their vendor to meet future needs.

EMRs: Still Not Living Up to Vendor Promises

How well does your vendor live up to the promises it makes about the EMR?

Top Frustration: Integrations

Today’s healthcare C-Suites are at a technology crossroads: the market is flooded with point solutions for capabilities from AI and cybersecurity to revenue cycle and virtual care, but integrating those technologies with EMRs and other platforms is frustrating employees more than ever.

C-Suite executives specifically say that despite the policy relaxations around telehealth during the last three years, telehealth and in-home hospital tools are not yet well integrated with EMR platforms. Only approximately one-third (37%) say telehealth integrates “moderately well” or “very well” into their EMR, and even fewer (14%) say in-home care services integrate “moderately well” or “very well” into their EMR.

Telehealth and hospital-at-home both signal a more connected IoT future for healthcare. But the models are not yet progressing as quickly as many leaders might hope given the high expectations and promise for extending care into those settings to reduce operational and medical costs and improve health outcomes.

Why C-Suites are Looking Outside the EMR for New Tech Capabilities

As a result of general dissatisfaction with their EMR and vendor, 43% of executives say their organization is looking outside the EMR when purchasing new technologies in 2023, an increase from the 38% that sought solutions outside their current EMR in 2022.

Patient safety was the top reason for evaluating solutions outside their current EMR in 2020 and 2022. In 2023, however, “our current EMR isn’t improving workflows” moved up

and is now tied as the top reason. That is particularly concerning as inefficient or frustrating workflows negatively impact burnout at a time when 61% of leaders rank workforce resilience among their top challenges in the next two years. Other challenges include achieving financial sustainability, lowering the costs and increasing access to care, and leveraging evolving payment models. That said, a positive development among EMRs is the finding that fewer survey respondents are looking outside the EMR because of quality, cost, and ROI issues than in our 2022 or 2020 surveys.

Given the above findings, it’s not surprising that more C-Suites in 2023 (60%) are prioritizing EMR optimization than did so in 2022 (50%) as a top technology initiative for the next 1-2 years. Others top tech initiatives include: workforce management, hospital operations, digital health to advance the patient experience, and improving patient flow.

Reasons C-Suites Look Outside the EMR for New Technologies

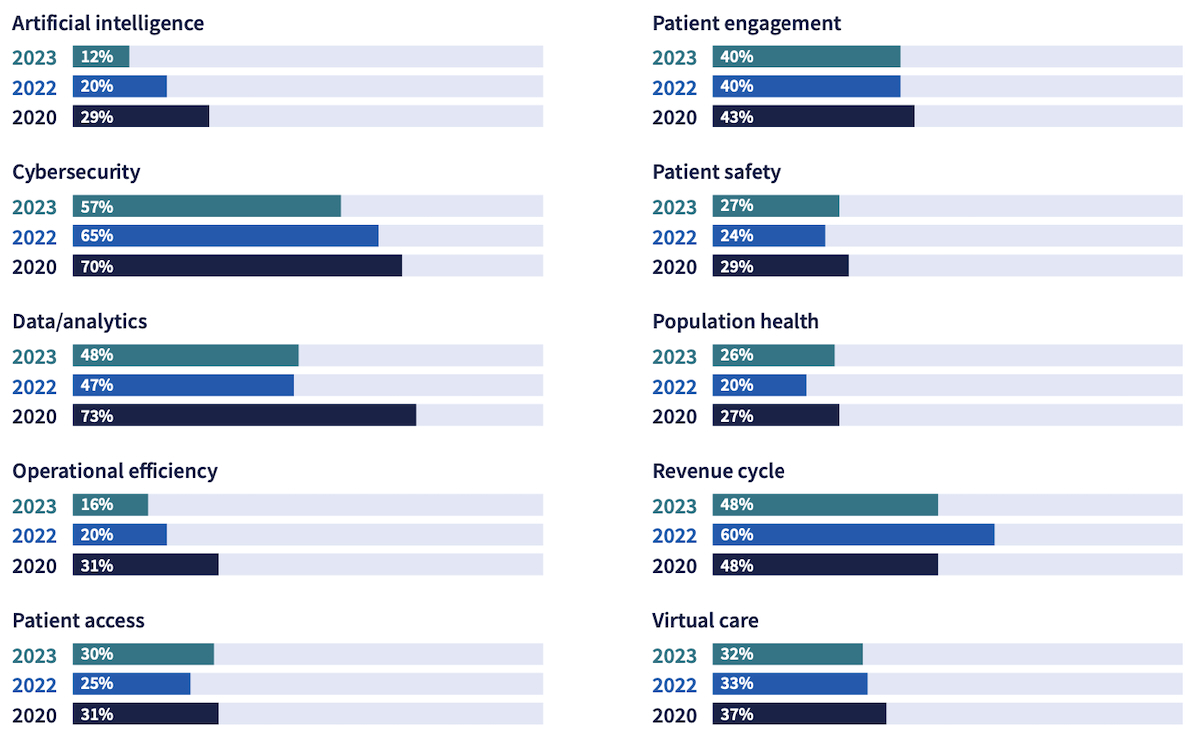

Where C-Suites are Investing Outside the EMR Today

In 2022, C-Suites ranked cybersecurity as their top health IT investment outside the EMR, followed by data analytics and revenue cycle. This year respondents indicated their hospital or health system is already investing more in revenue cycle and data analytics, and less in cybersecurity outside the EMR.

At the same time, C-Suites are still trying to determine effective payment incentives for virtual health and digital tools. The much-hyped artificial intelligence is showing considerable promise, but it’s not yet entirely clear what practical applications will be sustainable or how to derive a return on AI investments.

Our annual C-Suite Survey also examines executives’ perspectives on the likelihood of a recession in the near-term, a reality check on the industry’s progress advancing health equity, and a health IT forecast showing the top capital budget priorities, tech initiatives, and planned investments for the next two years.

Health IT Segments Respondents’ Organization Already Invested in Outside the Current EMR: 2023 vs. 2022 vs. 2020

Download our full research report, The New Healthcare C-Suite Agenda: 2024-2025, to learn more about top strategic considerations, where healthcare organizations are investing in technology to achieve those, current clinical and operational use cases for AI and where hospitals are exploring new ways to leverage AI, and more.